In Recognition of PTSD Month, Meet the Problem with A Solution Rather than A Solution to The Problem

Dr. Carolee Dasher attended Wayne State University earning a BSW and Ohio Northern University Pettie College of Law earning a Doctor of Jurisprudence. (Latin term meaning law.) She has over 15 years of experience in the financial industry.

PTSD is more recognized today than it ever has been. Awareness is the first step. Treatment typically follows. But as with all mental illnesses, it is often left untreated.

It seems to be the chicken or the egg perplexity. The lack of facilities and cost of treatment feed each other the perfect opportunity for blame. But the reality is millions suffer every day from untreated PTSD.

Post-Traumatic Stress Disorder (PTSD) is a debilitating psychiatric condition affecting approximately 3.5% of adults in the United States every year. It is estimated 1 in 11 people will be diagnosed with PTSD in their lifetime. Although this disorder can affect anyone, we know 20% of combat veterans develop PTSD.

PTSD was not officially recognized until the 1980’s. Prior to its recognition, “shell shock” or “combat fatigue” labels were used in diagnosing soldiers returning from war. With further research we now know, its’ affects date back to war veterans in the Civil War, World War I and World War II.

Today, PTSD symptoms are being further recognized in those suffering traumata from near death experiences such as auto accidents, assault, house fires and domestic violence. It has been linked to depression, anxiety and other conditions leading to self-medication often resulting in addiction.

Symptoms of PTSD are grouped by impairment levels classified as serious, moderate, or mild. It is estimated 36.6% of adults experience serious impairment, 33.1% have a moderate impairment and 30.2% have mild impairment. This is concerning considering we know functional status has a significant impact on quality of life.

PTSD sufferers with serious impairment struggle with basic day-to-day activities, known as “Activities of Daily Living” (ADL). An ADL refers to the basic skills needed to properly care for oneself and meet one’s physical needs in six areas: eating, dressing, bathing, toileting, continence, and mobility. Further evaluations are used to determine the level of care required and what supportive services a care plan should include. A person may be totally independent, require minimal or moderate assistance, or be completely dependent on another person in each area. Studies have shown ADL disabilities are associated with an increased risk for mortality.

Although PTSD can be a long-term disability requiring a lifetime of care, it is often left untreated. Unfortunately, it is not as easily recognized as dementia, Alzheimer, or other severe mental illnesses. Symptoms can be disguised and or misdiagnosed making treatment even harder to receive. Long term treatment and assistance with ADL’s are not typically covered by traditional medical insurance. Long-term care coverage in the insurance industry is a category all of its own.

ADLs are used as an eligibility criterion for VA Aid and Attendance pension, and applicants for Social Security disability benefits. These programs offer medical coverage with limitations. To qualify there must be failures in performing ADLs. Without those two avenues for aid, private insurance is the only option.

Private insurance would include disability policies for short- and long-term care. Employers may offer group plans at a lower cost and minimal health qualifications if any. If employment benefits are not an option, an independent policy would be needed. These types of policies can be cost adjusted to try and meet a budget but often are still too much for many young Americans. This is concerning considering PTSD is a diagnose for children, young persons, middle-aged persons and the elderly.

So, why not meet the problem with a solution? If the focus is to meet the disability with care, rather than make the disability meet a diagnostic solution, more creative ways to receive efficient medical coverage becomes available.

For example, a young 24-year-old severely impaired military combat veteran completes his enlistment time and returns to civilian life. Although he qualifies for VA aid, the wait is long, and the diagnosis must be the solution before he can begin care. But in the meantime, he can immediately get the help he requires with his life insurance policy. Later aid will still be a contribution in helping with his condition. However, he does not have to go untreated and live a lesser quality of life.

This example represents the use of living benefits within a life insurance policy contract. Rather than a death benefit paid out at the time of death, the death benefit is “accelerated” and used while living for medical treatment. Living benefits are paid to the policy owner directly. Payment can be a lump sum, monthly or an annual payment. Each carrier determines the amount and mode of payment taking into consideration the medical condition.

The insurance industry has long used ADLs as a measuring stick when offering living benefits in various types of life insurance. They determine policy cost, riders and limits based on health conditions in offering disability and life insurance, annuities, and long-term care policies. Each insurance carrier has their own unique categorization for certain types of medical conditions. Conditions typically fall within chronic injury, chronic illness, critical illness or terminal illness. Each category requires failures of ADLs as the trigger for initiating benefit payments.

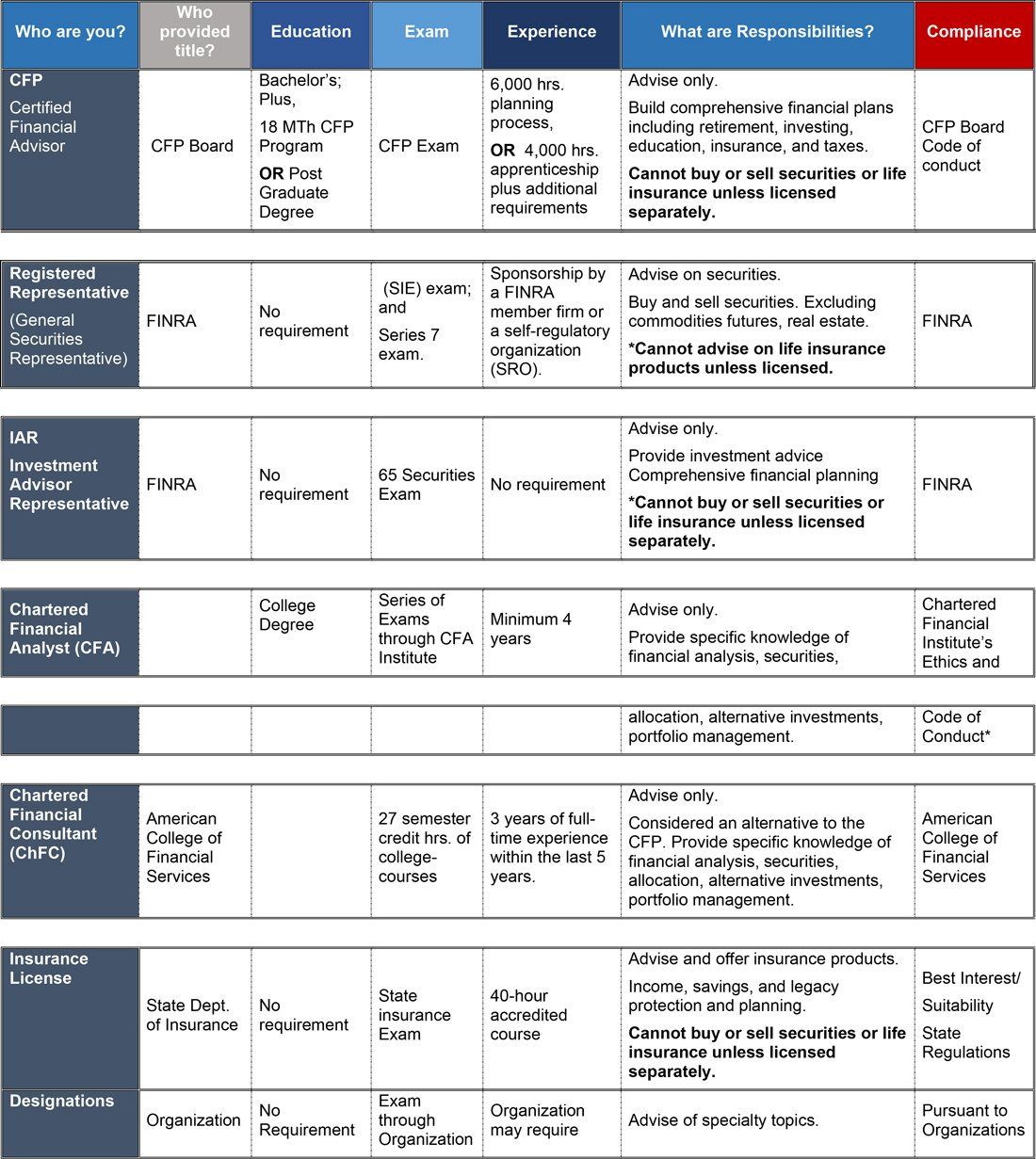

Living benefits coverage can last a lifetime or until benefits have maxed out in some cases. The cost-of-living benefits vary depending on the type of policy they are attached to and the value of the policy. As with all life insurance products health plays an important part in determining premium costs. Carriers look to a variety of factors including age, current health and gender. The benefits can be “built into the policy contract” or “added on” as riders. The insurance industry offers living benefits commonly through annuities and term, whole and universal life policies.

It comes with no surprise; early planning is always the cheaper and best route. But cost is still surprisingly reasonable for middle age adults in term, whole and universal life policy contracts. Some living benefits as riders are included with your policy, some riders are added to for additional premiums, and some require further medical underwriting with an additional charge. Most importantly, a policy can be positioned to meet goals and budgets at a particular age and revisited later for changes.

Take a look at the following average costs:

Average cost of life insurance by policy type

Living benefits with annuities are set up similarly. Some annuities have built in living benefits while others offer additional riders. Likewise, some are free of a rider charge while others assess an annual fee typically between .95% - 1.95%. Annuities can be complex and complicated with language. As with all planning, it is important to understand how a particular policy contract works to ensure goals are met.

The reality is 3 out of 10 Americans will face a disability lasting 90 days or longer sometime during their lifetime. Roughly 300k young Americans between the ages of 17-24 join the Military yearly with certainty 60,000 of those young American will be affected with PTSD. Imagine if part of initial enlistment preparation was a planning class educating and offering affordable life insurance with living benefits for “extra care”.

The evidence is there. We need education. We need more living benefits. We need more “extra care” rather than long term care. Perhaps one step in the right direction would be to remove the stereotype of “long term care” being for the elderly and focus on extra care in planning for all. Changing the minds of not only those who Average Annual Rate based on $500,000.00 20-year term life Whole life Universal Life Age Men Women Men Women Men Women 30 $227 $193 $4,015 $3,558 $2,345 $2,014 40 $341 $289 $6,042 $5,413 $3,263 $2,840 50 $842 $654 $9,432 $8,440 $4,925 $4,260 Source: Quotacy would benefit from this type of planning but also those who can educate and offer these available policy options.

Planning is not just for the wealthy. In fact, the risk of not being able to afford care at the time of need weighs more heavily on those with less. Educating one another is also helping one another. Meet the problem with a solution.